- The Data Tapes

- Posts

- The Data Tapes

The Data Tapes

Setpoint's Bite-Sized Debt Newsletter: February Edition I

The Latest in ABS and Debt Markets

Welcome to The Data Tapes—your biweekly snapshot of private credit and ABS markets. In each edition, we bring you concise updates on debt financings, platform fundraises, data insights, market trends, and the latest from Setpoint.

🚀 What’s New at Setpoint

🔦 ABF’s Risk Reckoning: We hosted a dinner with ABF leaders across banks, funds, and asset managers to compare notes on what’s changing in the industry and where risk is showing up first. Our Co-Founder and CEO Stu Wall captured four takeaways from the conversation, and what they mean for operators and capital providers. Read the blog.

💡 Lessons From a Market Wake-Up Call: Recent failures in asset-backed finance have raised the bar for transparency and control—our Head of Capital Solutions, Bart Steenbergen, breaks down what’s driving this reset and the verification standards lenders need to meet rising expectations from boards, investors, and regulators. Download the whitepaper.

🤝 On the road this winter — let’s connect. We’re attending SFVegas, Feb. 22-25, and we’d love to meet you. Book time with our team.

💸 Debt Financings & Acquisitions

Avtech Capital, an equipment finance and leasing company, completed its inaugural ABS deal of $141M backed by a portfolio of commercial equipment leases.

Consumer Portfolio Services, an auto finance platform, closed a $345.6M ABS issuance secured by a pool of subprime auto receivables.

Create Music Group, a digital rights monetization platform, is investing $300M in Nettwerk Music Group to fund a management buyout and provide additional growth capital.

Exponent Financial, a US-based specialty finance originator, closed a $20M senior secured revolving credit facility from Jovian Capital.

Firmus, an Australia-based data center infrastructure and compute capacity provider focused on AI, closed $10B in debt financing from Blackstone and Coatue to fund the next phase of Project Southgate.

Float, a Canadian business finance and banking platform, closed $100M CAD through two debt facilities with SVB and a tier-1 Canadian bank.

GLS, a subprime auto lender, closed a $907.7M ABS issuance secured by a pool of subprime auto loans.

Greenbriar, a rail equipment company, issued a $300M ABS deal through its subsidiary GBX Leasing secured by a pool of railcars and leases.

Jersey Mike’s, a QSR chain owned by Blackstone, closed a $760M whole business securitization secured by revenue from existing and future franchise agreements.

Kinetic Advantage, an independent floorplan financing platform, closed a $225M credit facility with MUFG to scale origination volume.

Lendable, an asset-based credit platform, closed over $500M with the launch of two new funds.

MidOcean Partners, an alternative asset manager, closed a $100M revolving credit facility from Cross River Bank to support the acquisition of HEI contracts from Point.

Nada, an home equity investment platform, closed a $150M forward flow purchase agreement with Medalist Partners.

Neo, a Canadian fintech and neobank platform, closed a $68.5M equity financing from AIMCo, Northleaf, Sandstone Asset Management, and others.

Pasadena Private Lending, a private credit provider to lower middle market businesses, closed a $105M strategic capital partnership with Eagle Point.

PEAC Solutions, an equipment finance platform, closed a $680.8M ABS issuance collateralized by equipment loans and leases.

Peachtree Group, a vertically integrated U.S. commercial real estate investment, closed a $50M warehouse facility from Western Alliance Bank to support the extension of Peachtree’s equipment finance division.

Propy, a real estate technology company, closed a $100M credit facility from Metropolitan Partners Group to finance the acquisition of title and escrow businesses.

Saluda Grade, an alternative investment firm focused on asset-based finance, closed a $367M securitization backed by recently originated first- and junior-lien HELOCs originated by Homebridge Financial Services.

Serverfarm, a data center infrastructure provider, closed its inaugural ABS deal issuing $589M secured by three facilities in Atlanta, Chicago, and LA.

Sotheby’s Financial Services, Sotheby’s captive art financing company, closed a $900M securitization backed by art-secured loans and collectible car-secured loans.

Upgrade, a consumer finance originator, upsized its revolving credit facility with Cross River Bank to $250M to finance its personal credit line assets.

Vantage, a hyperscale data center campus, closed a $2.4B debt facility with Ares to refinance existing debt and support development and construction of new data center campuses.

Vervent, a servicing technology platform, closed a forward flow agreement with Mesirow Alternative Credit of up to $80M to support origination of unsecured credit cards across Vervent’s portfolio.

💰️Platform Growth

AB CarVal and Investec launch a new aviation financing platform to provide secured asset-backed lending solutions to airlines and aviation leasing companies.

Apollo and Schroders announced a strategic partnership to develop wealth and retirement investment solutions for UK clients.

Atlas Real Estate Partners launches A4 Credit Partners to originate small-balance residential transition loans.

Banco Santander entered into an agreement to acquire Webster Financial Corporation for $12.2B.

Benefit Street Partners announced the purchase of a $391M loan portfolio secured by eight multifamily properties across the US.

Catalyst Investment Partners, one of the largest owners and operators of industrial outdoor storage, announced the final close of its third fund at $400M in LP commitments.

Coller Capital closed a continuation vehicle for Ares US Direct Lending’s 2018-vintage fund with more than $1.3B in commitments.

Crescent Capital closed a $3.2B private credit CV to acquire a portfolio of performing loans from Crescent Mezzanine Partners’ 2016-vintage fund with Pantheon.

Dawson Partners is launching a credit secondaries strategy.

Fern Ridge Capital, a London-based credit fund, set a $250M target for its debut asset-based finance fund.

Great American Holdings launched Great American Capital Corporation to originate collateral-backed middle-market loans between $20-100M.

KKR to acquire Arctos Partners, an institutional investor in professional sports franchise stakes and asset management solutions for sponsors, in a transaction valued at $1.4B.

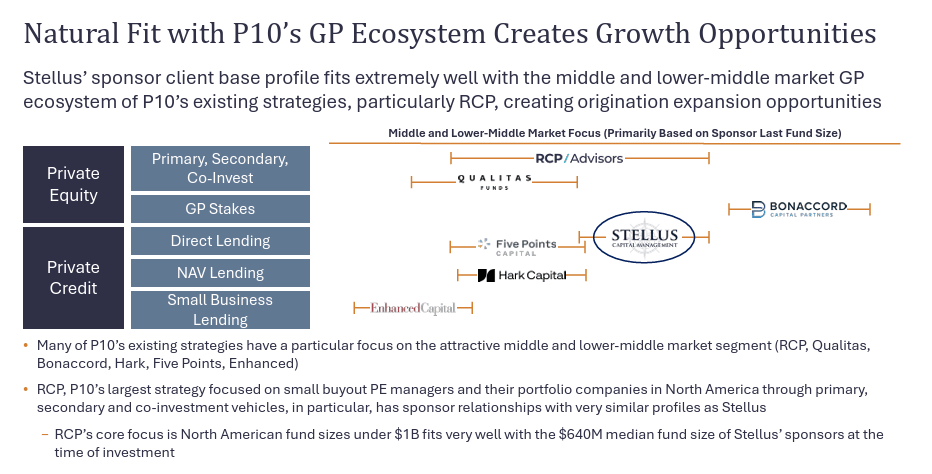

Ridgepost Capital (fka P10) acquired Stellus Capital Management, a $3.8B AUM lower-middle market direct lending platform for $250M upfront with an additional $60M in earnout consideration.

Victory Park Capital and Privacore Capital, affiliates of Janus Henderson, launch Privacore VPC Asset Backed Credit Fund, a registered interval fund to provide institutional quality exposure to asset-backed credit.

Viola Credit launched a $300M fund called Customer Growth Financing to offer credit solutions to B2C startups to finance direct market expenses for customer acquisition, competing with General Catalyst’s Customer Value Fund.

📈 Visuals

Source: S&P

Source: S&P

Source: Oaktree

Source: Oaktree

Source: Ridgepost Capital (fka P10) Investor Relations

Source: Apollo

Source: Evercore

🗣️ Market Commentary

“There’s tremendous latency between when problems happen and when they’re found out by the market. There’s been incredible ‘innovation’ for better or worse in terms of hiding those markets in various ways. Hold to maturity, LMEs, or different forms of secondary transactions that allow people to kick the bucket further and further down the road. I think it’s a 2027 to 2032 problem. If you think about leveraged finance, you may not see secondary market bank debt trading down, but you will see that very same company coming to us to factor their receivables or lease their equipment at very high rates or potentially give up certain collateral that they otherwise wouldn’t to keep things going. They alternatively might be part of a secondary transaction that allows it to move along as well. The balloon gets pushed and it comes out in different ways that we haven’t seen before but it’s there “ - Dan Zwirn, Founder, CEO, and CIO of Arena Investors on latency between credit fundamentals and market feedback

“We can look into those databases, and we can see exposures, whether the company’s growing. We can see leverage levels. We can see equity coverage. What we’re seeing is defaults are sitting at sub-2%—which is historically their normal low—and dropping. It’s been low, and it’s staying low. It’s actually dropping further. And leverage levels, if we put them in context, are actually not rising. They’re staying flat or dropping, which means equity coverage is also rising. All those data points are kind of flashing green. The opaqueness is what is concerning to people. And that I understand. It’s that you don’t have the ability to look in our database today to see what’s happening in there. But I think there is enough data available around the big points of average lending levels, equity coverage, default rates, etc., that I think are just not showing you that there’s some big crisis on the horizon.” - Erik Hirsch, Co-CEO of Hamilton Lane on overblown fears surrounding private credit

“The ABF space, asset-based finance space is the hottest thing that any asset manager is going out to talk about. Our ability to differentiate ourselves where we could actually originate these loans and service these loans gives us a real edge over a lot of competition. So you're going to continue to see, I think, the non-agency space grow. We just got to make sure that not just on us, quite frankly, as an industry, we maintain discipline around credit here.” - Michael Neirenberg, Rithm Chairman, President, and CEO on Rithm’s structural advantages in the ABF market

“The tech portfolio continues to be the most pristine amongst all of our portfolios, amongst all of our subsectors. I appreciate we're all looking forward, but remember, these are loans that are on average 30% of the value of the enterprise at the time of acquisition or LTV, with huge equity cushions. These are companies, on average, let's be fact-based as opposed to headline-driven. Since November 2022, the advent of ChatGPT as some kind of moment of AI's arrival, since that time, the portfolio on average has grown revenue 40% and EBITDA 50%. We'll bring it much more current because we can all agree that in November, it was doing poems, so maybe it didn't matter. But let's bring it to this quarter. Fourth quarter, the revenue growth was 10%, and the EBITDA growth in those software names was mid-teens. That's fourth quarter, quarter over quarter. It is not a monolith, and it's listen. This is the opportunity. Obviously, when this happens, of course, markets get deeply disrupted.” - Marc Lipschultz, Blue Owl Co-CEO on Direct Lending exposure to software businesses

📖 What We’re Reading & Listening To

Earnings

Investment & Macro Outlooks

2026 Investment Perspectives (Blackstone)

Crescent Private Credit Insights: January 2026 (Crescent)

Reading

2025 Annual FinTech Almanac (FT Partners)

AI’s Promise and History Lessons (Guggenheim)

AI’s Lending Risk Getting Tougher to Compute (Bloomberg)

Easy-Money Loans Backfire on Rookies in the Home Flipping Market (Bloomberg)

Hobbit-Inspired Startup Becomes First New Bank Greenlighted by Trump 2.0 (WSJ)

How Ares Built an ABF Platform the Slow Way (Covenant Lite)

How Fake Invoices Duped BlackRock Unit into a $400M Loan (WSJ)

Podcasts & Interviews

Disperson (Oaktree)

Distressed Buyer HIG Sees Most Loan Distress In Years (Bloomberg Credit Edge)

Don Edwards: From Billions in Private Equity to 100,000 Students (Forged In America)

Hard Lessons: Blackstone President and COO Jon Gray (Morgan Stanley)

Jonathan Lewinsohn - Credit Microcycles at Diameter (Capital Allocators)

Mike Gitlin: Inside Capital Group’s Philosophy, Ownership Model, and Long-Term Edge (In Good Company)

State of Distressed Debt: Andrew Milgram on Middle-Market Opportunity (Bloomberg FICC Focus)