- The Data Tapes

- Posts

- The Data Tapes

The Data Tapes

Setpoint's Bite-Sized Debt Newsletter: January Edition I

The Latest in ABS and Debt Markets

Welcome to The Data Tapes—your biweekly snapshot of private credit and ABS markets. In each edition, we bring you concise updates on debt financings, platform fundraises, data insights, market trends, and the latest from Setpoint.

🚀 What’s New at Setpoint

💡 Lessons From a Market Wake-Up Call: Recent failures in asset-backed finance have raised the bar for transparency and control—our Head of Capital Solutions, Bart Steenbergen, breaks down what’s driving this reset and the verification standards lenders need to meet rising expectations from boards, investors, and regulators. Download the whitepaper.

🚀 We’re Growing at Setpoint: Fresh off being named 2025 Fintech Game-Changer of the Year by Opportunity Austin’s A-LIST Awards and #1 Startup in Austin on LinkedIn’s 2025 Top Startups list, we’re expanding our team across key roles. Check out our open positions.

💸 Debt Financings & Acquisitions

Achieve, a consumer finance platform, closed a $271.2M securitization backed by newly originated HELOCs. The company also closed its first debt settlement fee securitization, a $217.2M issuance backed by fees earned through Achieve Debt Relief.

Atlanticus, a consumer finance platform, refinanced an existing $750M term securitization facility through the Mercury subsidiaries of Atlanticus.

Balancehero India, the parent company of True Credits, closed a $75M USD credit facility from CIM.

CapRelease, a UK-based embedded finance platform for ecommerce retailers, closed a $33.3M senior debt facility from PFG alongside a $2.7M equity financing.

Cross River Bank, a NJ-based bank and fintech platform, completed a $288M CMBS issuance converting a pool of commercial real estate loans into bonds purchased by institutional investors.

DailyPay, an earned wage access platform, closed a $195M senior secured revolving credit facility with JPMorgan.

Enova, a consumer finance platform, agreed to acquire Grasshopper Bank, a digital bank with $1.4B in assets, for an aggregate purchase price of $369M.

Equify Financial, a commercial lending platform, closed a $100M capital facility with JPMorgan to scale origination volume and strengthen its balance sheet.

EquipmentShare, a connected jobsite and construction equipment rental platform, closed its fourth ABS deal raising $454M secured by EquipmentShare-managed equipment.

Finance of America Companies, a home equity-based financing platform, closed a $2.5B strategic partnership to support origination growth alongside a $50M equity investment with Blue Owl.

Forward Financing, a small business financing platform, closed its first ABS transaction totalling $170M.

Harvest Commercial Capital, a small business lending platform, closed a $1B forward flow program with Blackstone (BXCI) to acquire business loans secured by first lien mortgages of owner-occupied commercial real estate.

i80 Group, an asset-based credit fund, announced the acquisition of $250M of re-performing auto loans from a global financial institution.

Imprint, a co-brand credit card issuance platform, raised a $150M Series D at a $1.2B valuation led by Khosla Ventures, with participation from Thrive, Ribbit, Kleiner Perkins.

Katapult, a consumer lease-to-own platform, entered into an agreement to combine with The Aaron’s Company and CCF Holdings in an all-stock transaction.

Lendistry, a tech-enabled small business lender, closed a $100M debt facility from KeyBank.

Mondu, a Berlin-based B2B payments platform, closed a €100M debt facility from JPMorgan to scale payment solutions and expand across Europe.

Morpheus Lending, a UK-based digital bridge lending platform, closed a £110M senior funding line with Pollen Street.

Octane, a financial platform for recreational purchases, raised $100M Series F equity financing led by Valar Ventures alongside Upper90 and Huntington Bank.

Pagaya, a consumer finance and residential real estate platform, closed a $321.4M ABS deal backed by a pool of unsecured consumer loans.

Plata, a Mexico-based financial technology company, raised $500M in financing capacity from Nomura to scale origination growth.

Point, a home equity investment platform, closed a $600M forward flow purchase agreement with MidOcean Partners.

Redaptive Sustainability Services, an integrated energy-as-a-service platform, closed a $216M ABS deal secured by a pool of 1,445 performance contracts from 46 F500 obligors.

Rostrum Pacific, an independently operated music company, closed a $150M financing from Crayhill to identify, acquire, and grow music catalogs.

Unlock Technologies, a home equity investment platform, closed a $403.9M ABS deal secured by HEAs originated and managed by Unlock.

Vield, an Australia-based crypto-backed lending platform, closed a $50M warehouse facility to finance secured loan originations.

Willis Lease Finance, a commercial aircraft engine lessor, closed a $1B partnership with Blackstone to scale growth of their current and next gen aircraft engine portfolio.

Zip, a consumer BNPL platform, closed a $283M warehouse facility with Victory Park and ATLAS SP.

💰️Platform Growth

Abacus Global Management, an alternative asset manager, launched an asset-based finance strategy led by Monty Cook and Elena Plesco.

Beach Point closed its second CLO totalling $402.5M, bringing the firm’s CLO origination platform to $1.7B.

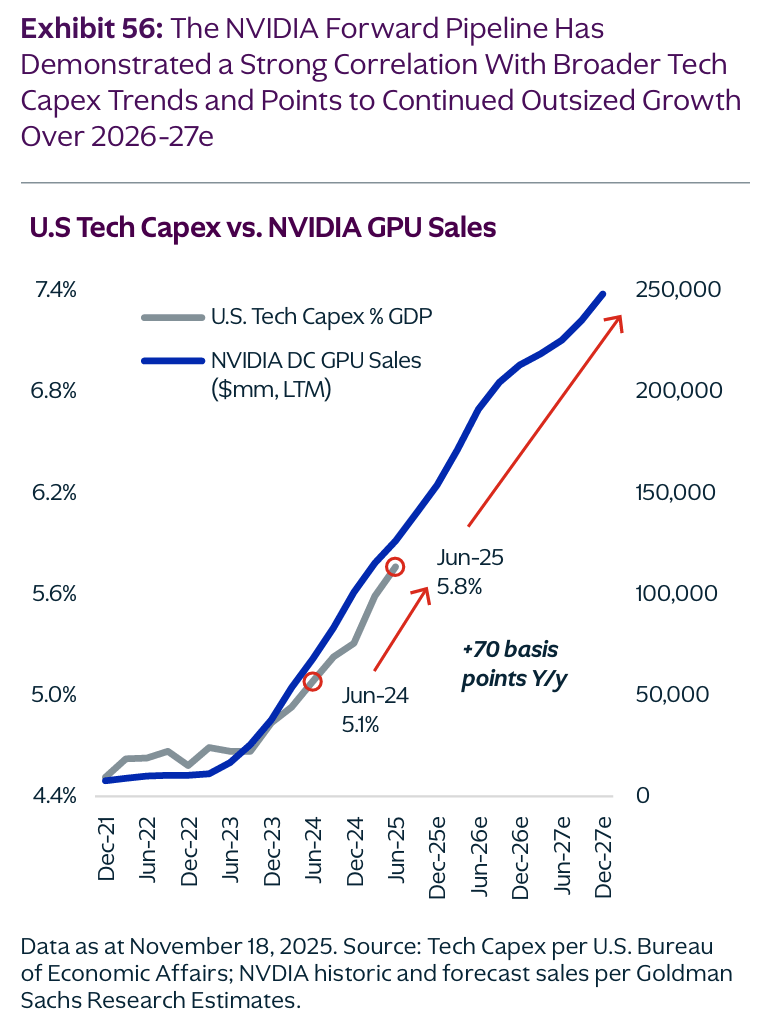

Brookfield is launching its own cloud business to lease chips inside data centers directly to AI developers.

Deerpath Capital Management, a provider of senior, cash-flow based loans to sponsor-backed lower middle market borrowers, closed Deerpath Fund VII, exceeding its $2B target.

First Eagle Investments to acquire Diamond Hill Investment Group for $473M.

Janus Henderson Group plc to be acquired by Trian Fund Management and General Catalyst for $7.4B.

KKR launches a European Rail Leasing platform with Green Mobility Partners to support demand for sustainable rail infrastructure in Europe.

Monroe Capital launched Monroe Capital Enhanced Corporate Lending Fund (MLEND), a perpetual life, non-traded BDC to provide access to retail investors.

PIMCO raised more than $7B for its asset-based finance strategy.

Pinnacle Financial Partners announced the completion of the merger of Pinnacle Financial Partners and Synovus, operating as one bank holding company with a pro forma combined $117.2B in assets, deposits of $95.7B and loans of $80.4B.

Silver Point Capital acquired a controlling interest in claims of Onset Financial and certain of its funding partners against First Brands Group and affiliates.

SoftBank to acquire DigitalBridge, a global asset manager managing $108B of infrastructure assets, for $4B to expand SoftBank’s data center and connectivity capacity for AI.

TPG, Jackson Financial to establish a strategic investment management partnership with a minimum commitment of $12B of AUM, beginning with an allocation to TPG Credit, initially focused on Investment Grade Asset Based Finance and Direct Lending.

Transformco (formerly Sears Holdings), a provider of homeowner, loyalty, and financial services Fidem Financial, and Blue Owl, launched Aress Financial Services, a next-gen credit card and servicing platform for co-branded credit cards.

📈 Visuals

🗣️ Market Commentary

“The problem is that direct corporate lending has been pitched as a double-digit asset class, and it’s not today…As returns come down, it’s going to look more and more like a mid- to high-single-digit asset class.” - Tony Yoseloff, managing partner and chief investment officer at Davidson Kempner on return compression in direct corporate lending

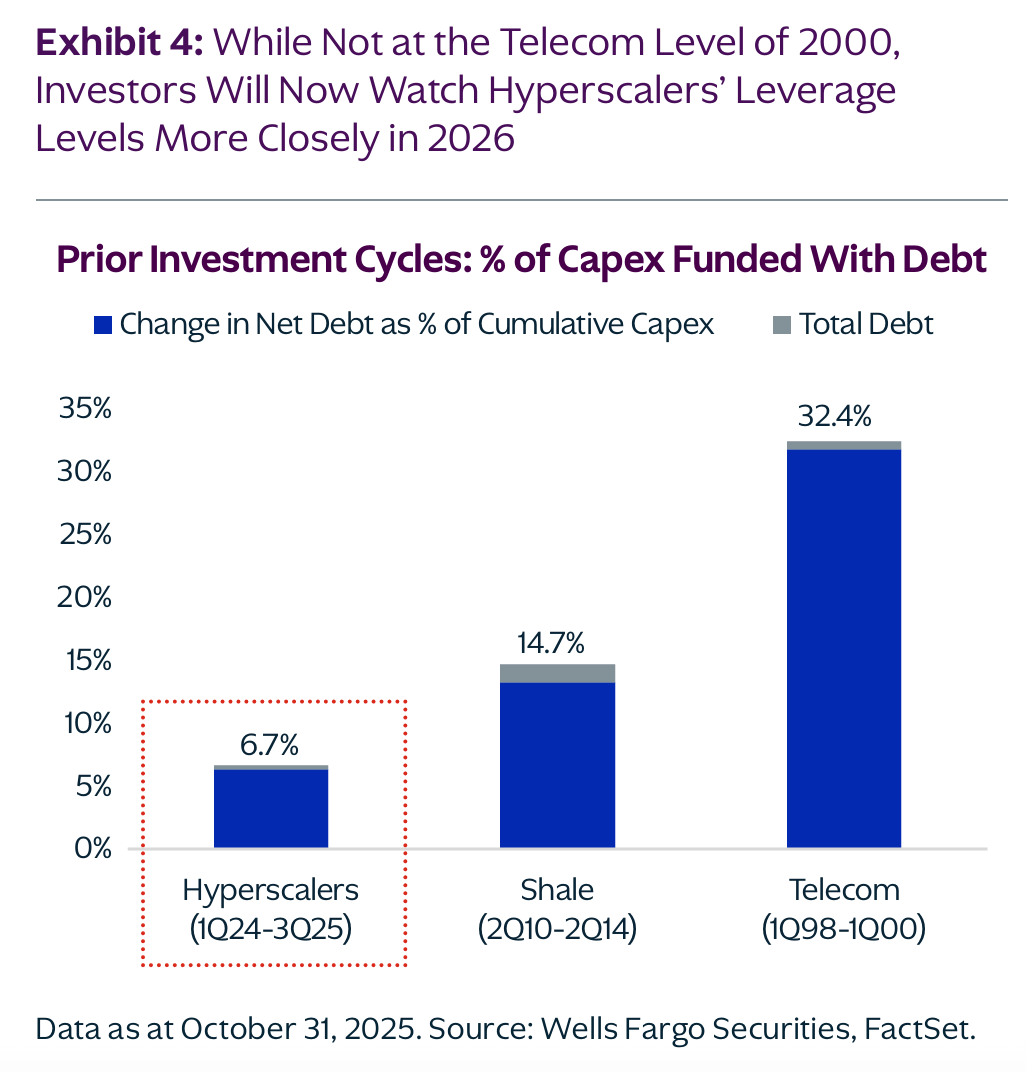

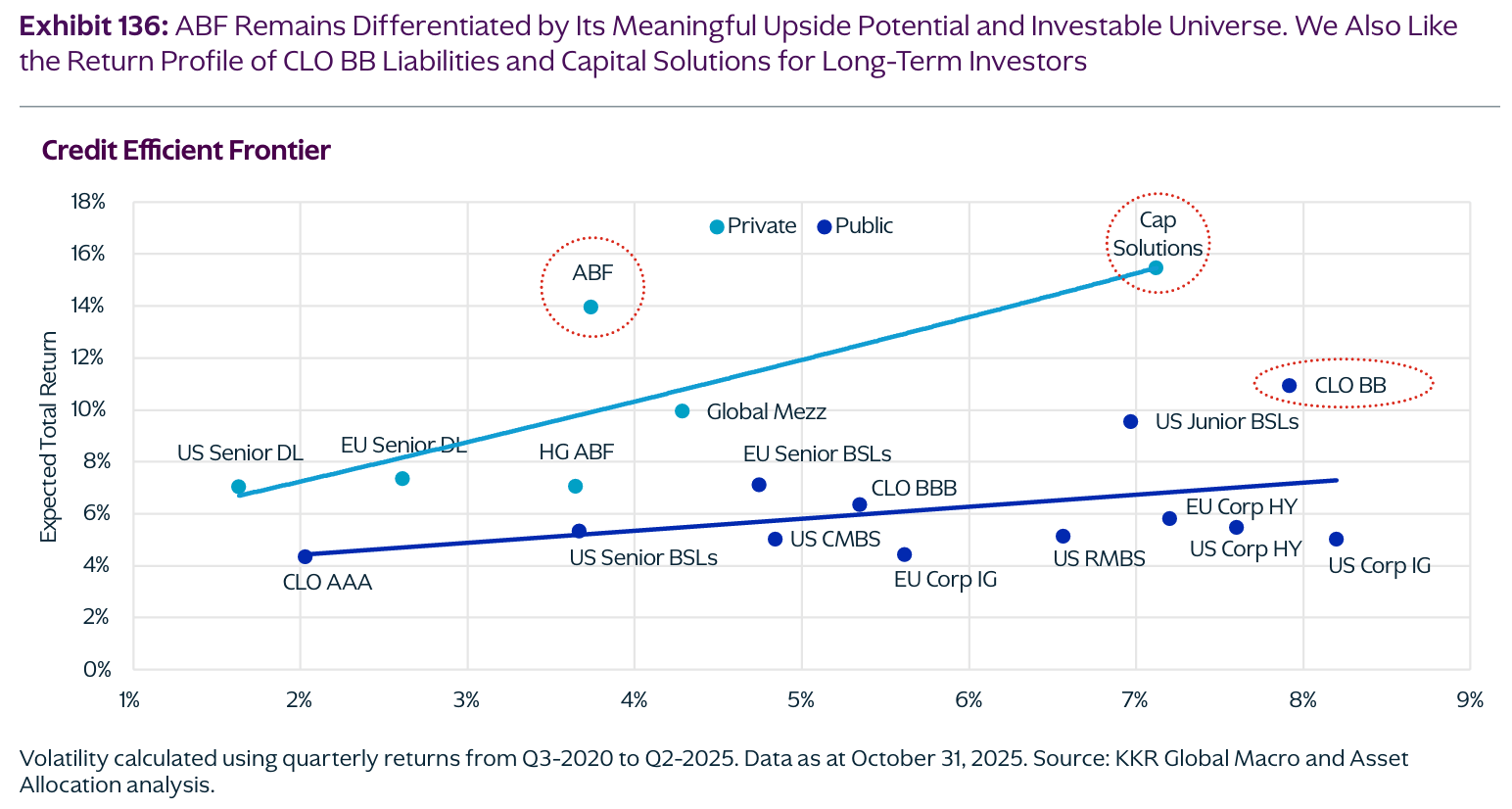

“Using an education analogy, we think a B is an A in this environment, but a C could be an F. Importantly, we do not believe that we are on the edge of a broad-based credit cycle in 2026. However, we do think that some of the excesses, especially from the 2021 vintage, are going to further manifest themselves in 2026. Beyond the 2021 vintage, pay particular attention to roll-up strategies that benefitted from suppressed interest rates and rich equity valuations coming out of COVID.” - Henry McVey, Partner & Head of Global Macro & Asset Allocation, CIO of KKR Balance Sheet on Caution around ‘Cheap’ Assets facing Competitive Pressures and Bad Balance Sheets

“What we have really seen this year is Europe kind of having its renaissance…Investors are much more intrigued about how to diversify geographically…If that reform — which looks like it’s trending in the right direction — happens, that can open up what we estimate as close to $1 trillion of high-grade ABF opportunities. Insurers today are essentially penalized from a capital charge perspective to hold that type of exposure.” - Tal Reback, global investment strategist at KKR on the ABF Opportunity in Europe

📖 What We’re Reading & Listening To

Investor Presentations & Outlooks

2026 Global Outlook: Pushing Limits (BlackRock)

2026 Outlook: The Year Ahead in 14 Sparks (Apollo)

Credit in 2026: A Market That Demands Insight, Not Just Capital (Carlyle)

Credit Outlook: Discipline Is an All-Weather Strategy (Brookfield)

High Grading - 2026 Outlook (KKR)

Private Credit: Fact vs. Fiction (Apollo)

Stone Ridge 2025 Investor Letter (Stone Ridge)

Reading

A Few Things We Learned - Q4 2025 (Octahedron Capital)

Barclays bet on personal loans with $800M Best Egg acquisition (Rohit Mittal)

Collateral Control Failures: What First Brands and Tricolor Reveal about ABF Oversight (Rithm)

Defaults on art-backed loans soar in struggling market (FT)

The Financing Gap in Sports: Unlocking a $2.5T Opportunity (Apollo)

The Institutional Migration of Merchant Cash Advance and Revenue-Based Finance (Edgar Matthews)

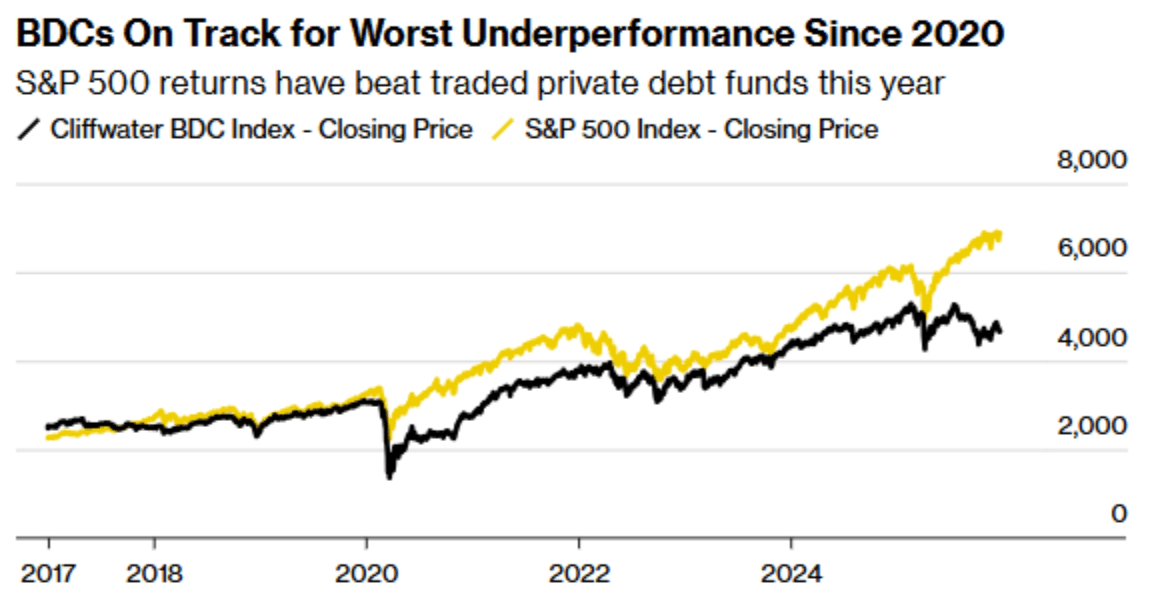

The Private Credit Party Turns Ugly for Individual Investors (WSJ)

Podcasts & Interviews

Blue Owl’s Sean Connor - a growth company in a growth industry that is investing in megatrends (Alt Goes Mainstream)

Credit Crunch: KKR’s Pietrzak on Asset-Based Finance, AI Impact (Bloomberg)

Mike Gitlin - The Century of Capital Group (Capital Allocators)

Patrick O’Shaughnessy, Colossus & Positive Sum (David Senra)

Unpacking First Brands, rise of coercive restructurings - Eagle Point founder Tom Majewski (Credit Exchange)

‘Who’s the Next Winner?’: Diameter Capital’s Scott Goodwin (GS)