- The Data Tapes

- Posts

- The Data Tapes

The Data Tapes

Setpoint's Bite-Sized Debt Newsletter: July Edition I

The Latest in ABS and Debt Markets

Welcome to The Data Tapes—your biweekly snapshot of private credit and ABS markets. In each edition, we bring you concise updates on debt financings, platform fundraises, data insights, market trends, and the latest from Setpoint.

🚀 What’s New at Setpoint

📖 Customer Spotlight: How Fundbox Scaled Smarter

As Fundbox expanded its funding programs and prepared for its first ABS deal, the capital markets team tackled rising complexity head-on. With Setpoint, they automated borrower reporting, optimized asset allocation, and strengthened lender relationships—unlocking more debt capacity and cutting reporting time in half. Read the full story

✨ Ben Rubenstein named to Inman’s 2025 Best of Finance list.

We’re proud to share that our Co-Founder and President, Ben Rubenstein, was recognized as one of Inman’s Best of Finance honorees for 2025 — highlighting leaders driving innovation in the lending ecosystem. Check out the full list

💸 Debt Financings & Acquisitions

AIP, an asset manager focused on asset-based finance, announced an Aircraft Leasing venture with Monroe Capital to acquire a diversified aircraft leasing portfolio of up to $1B.

Atlantic Union Bank, a US regional bank, closes a sale of approximately $2B of Commercial Real Estate loans to Blackstone at low 90s as a percentage of par value.

BBVA is in market for an SRT deal linked to $4.7B of corporate loans.

Butn, an Australia-based embedded invoice finance platform, closed a $100M debt facility with Northleaf to scale originations.

Canvas Cards, issuer of general purpose, Walmart-branded credit cards in Canada, closed a $250M ABS issuance backed by a pool of credit card receivables.

DailyPay, an earned wage access platform, completed its inaugural $200M ABS transaction backed by a pool of On-Demand Pay receivables.

Doc2Doc Lending, a lending platform for doctors, closed $25M in funding capacity from DR Bank and doubled its loan sale commitment with Rivonia Road to $100M.

Ferovinum, a funding and supply chain platform for the drinks industry, secured a $550M ABS program alongside Pollen Street Capital and a leading investment bank.

FrontRange Partners, a real estate private equity firm, announced a $150M programmatic JV with O’Connor Capital Partners to develop triple net leased assets across the East Coast.

GoodLeap, a home improvement loan platform, closed a $354.7M ABS issuance backed by a pool of home improvement loans.

Hertz, a rental car and fleet management firm, issued two rental car ABS deals totalling $685M in Hertz’s ABS Master Trust.

Jefferson Capital, a charged-off consumer debt buyer, raised $150M in an IPO.

Lendbuzz, a consumer auto finance platform, completed a $266M ABS deal collateralized by a pool of auto loans.

Meta is reportedly seeking to raise up to $29B from private credit investors to build AI data centers in the US.

NFS Capital, an equipment finance and asset-based lending platform, closed a $100M minority equity investment with Monroe Capital.

Princeton Digital Group, a data center operator, closes $400M in additional loan commitments from Allianz and Keppel Credit.

Renew Financial, a residential PACE and home improvement financing platform, closed a $175M forward flow agreement with 26North.

Wintermute, a digital asset trading desk, closed a Bitcoin-backed credit line from Cantor Fitzgerald.

💰️Platform Growth

26North hires Todd Marr and Ravi Suresh to join as MDs in 26North’s Investment Grade Alpha business that spans private credit and asset-based finance.

Apollo announced the launch of Olympus Housing Capital, a homebuilder finance strategy to provide capital solutions to homebuilders across the US to finance land acquisition and development.

Bain Capital, Warner Music Group launch a joint venture to purchase up to $1.2B in music catalogs across recorded music and music publishing.

BlackRock to acquire ElmTree Funds, a net-lease real estate investment firm with $7.3B in AUM. ElmTree will be integrated into Private Financing Solutions (“PFS”), a new platform created through the acquisition of HPS Partners. BlackRock also completed its acquisition of HPS.

Orix Corporation USA to acquire a majority stake in Hilco Global to complement Orix’s private credit and asset management business.

Pinegrove Capital Partners is raising an $800M venture debt fund targeting 13-17% net returns by lending senior secured debt to high growth VC-backed companies.

TPG completed its acquisition of Peppertree Capital Management, a communications infrastructure-focused asset manager, and will operate the $7.8B strategy as TPG Peppertree.

Victory Park Capital closed a $50M follow-on commitment from The International Finance Corporation (IFC) in Victory Park Capital Investor Fund W to expand SME financing in Emerging Markets.

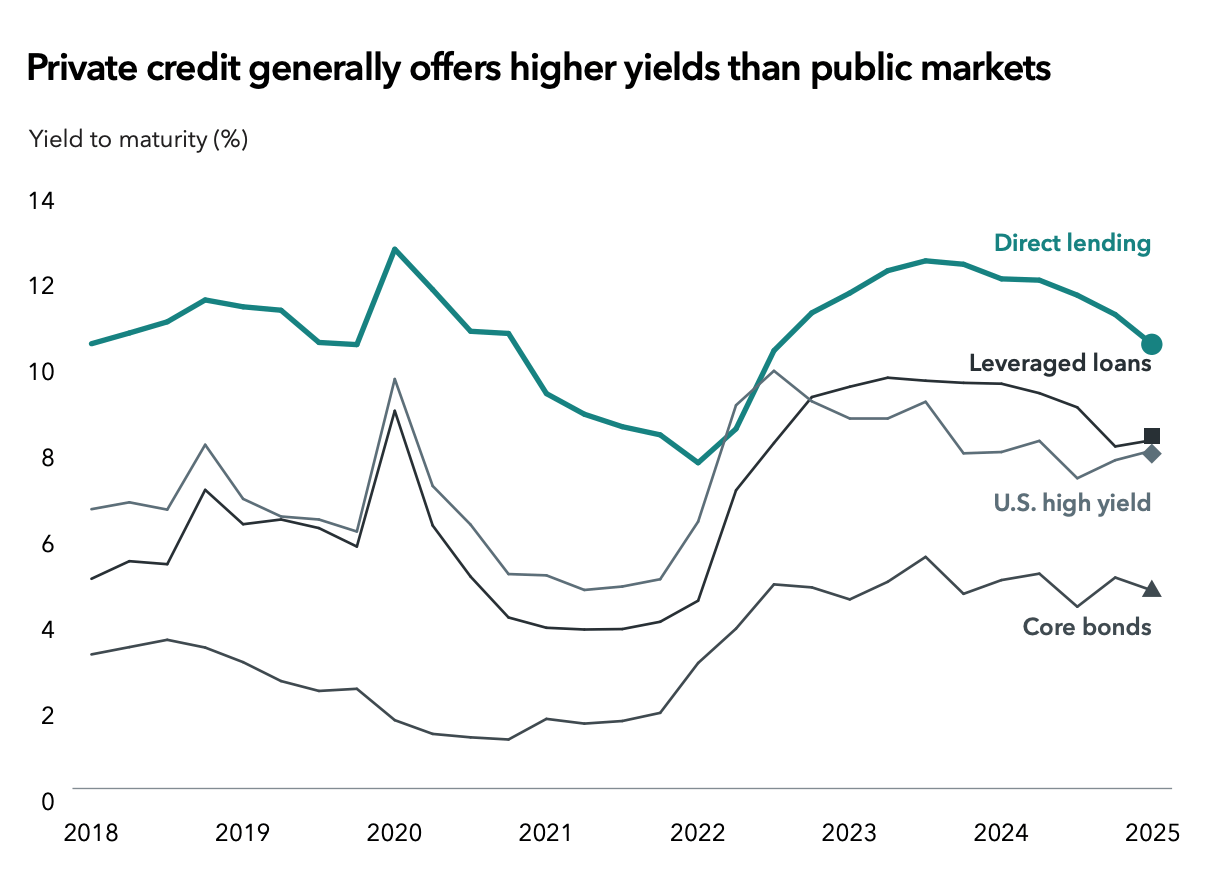

📈 Visuals

🗣️ Market Commentary

“What does a factory do? It’s, ‘I want to get as many widgets out the door as fast as possible, as cheap as possible…regardless of what the environment is.” - Alan Waxman, CEO of Sixth Street on the Risks of Commodification in Private Credit

“No one should be the least bit surprised when returns suffer and there are meaningful impairments in the recoveries of private credit lenders. Too much capital has come in too quickly to the private credit market, and its being allocated by firms with no proven track records as credit underwriters. One of the truisms of distressed-debt investing is that where there is an overallocation of capital, there will be mistakes.” - Andrew Milgram, Managing Partner and CIO at Marblegate on Tightening in Private Credit Markets

“Europe has probably shifted the most in terms of a positive forward trajectory in terms of the opportunity sets. We did not see the same exuberance in aggressive capital structures and buying activities like you did see in the US. From a legal perspective, Europe has a very strong backdrop in terms of creditor protections. Third, Europe is now stimulating its economy by spending, especially defense spending. We’re seeing a broad based increase in M&A activity in Europe.” - Armen Panossian, Co-CEO and Head of Performing Credit at Oaktree on the European market opportunity in Credit

“GPs and LPs also face other market pressures. Market volatility, particularly in public equities, has pushed some LPs to seek liquidity from private fund holdings to rebalance their overall portfolios so that they can meet strict asset-class allocation mandates. That has ratcheted up the pressure for GPs at older funds to return capital to LPs and raise capital for new funds. Yet those same GPs increasingly seek to maintain ownership over high-performing assets beyond their original fund lifetime, usually due to a desire to continue to create value from core “trophy” assets.” - Kevin Alexander, Ares Co-Head of Alternative Credit on Catalysts Fueling Growth in Fund Finance Opportunity

“Investment in renewable energy infrastructure may provide a clever way to tackle that challenge. The opportunity set in this arena is expansive. Last year, the world invested almost twice as much in clean energy as it did in fossil fuels, according to the International Energy Agency. Financing is increasingly coming from private capital providers who are able to structure assets that can meet life insurers’ unique needs. These assets can come with investment-grade ratings from the major ratings agencies, which may increase relative attractiveness on a capital-adjusted yield and spread basis. And maturities in the 20-year range make them a good match for insurers with long-term liabilities.” - Xiaoyu Gu, Deanna Leighton, and Gerry Anderson from AB CarVal on Overlaps with Clean Energy Infrastructure Investments and Insurance Capital

📖 What We’re Reading & Listening To

Reading

2025 Midyear Outlook (Capital Group)

A Few Things We Learned: Q2 2025 (Octahedron Capital)

Lenders Find a Fast-Growing Market in Foreign Grad Students (Bloomberg)

Global Credit Quarterly: 3Q2025 (BlackRock)

Hedge funds seek to expand into private credit (FT)

High-Deductible Health Insurance Plans and the Rise of BNPL in Healthcare (Solomon Partners)

Home Equity Investments: The Tipping Point for Alternative Financing (Hometap)

HPS Struts Into BlackRock as Fink Bets Big on Private Credit (Bloomberg)

International: A Glimpse into Global ABS 2025 (Baker McKenzie)

Liquidity Solutions: Are You Ready for the Next Stage of Fund Finance Growth? (Ares)

Litigation Finance Levy Cut from Tax Bill by Senate Referee (Bloomberg Law)

Private Asset-Backed Credit: How Structural Protections Drive Resilient Performance (Waterfall Asset Management)

Private Credit Outlook: Five Lessons Learned (AllianceBernstein)

Private Equity Outlook for the second half of 2025 (Apollo)

Trump’s Tax Bill Set to Help SoFi, Other Private Student Lenders (Bloomberg)

Podcasts & Interviews

A Promise to Pay with Michael Haynes, head of private credit at Beach Point (Grant’s)

Ares Co-President Blair Jacobson at SuperReturn International 2025 (Ares)

Investors First: Converging Public and Private Markets with Mark Rowan (Morningstar)

Private Credit Heavyweight HPS Sees ‘Huge Opportunity’ in Fund Finance (Bloomberg Credit Edge)

‘Proceed Cautiously’ with Private Credit: Oaktree co-CEO (Bloomberg)

Real Opportunity in Real Assets (Guggenheim Macro Markets)

Supply and Demand with Wayne Dahl and Suzana Perić (Oaktree Insights)

The Intersection between Asset Managers and Insurers with Mike Consedine of Athene (Credit Clubhouse)