- The Data Tapes

- Posts

- The Data Tapes

The Data Tapes

Setpoint's Bite-Sized Debt Newsletter: January Edition II

The Latest in ABS and Debt Markets

Welcome to The Data Tapes—your biweekly snapshot of private credit and ABS markets. In each edition, we bring you concise updates on debt financings, platform fundraises, data insights, market trends, and the latest from Setpoint.

🚀 What’s New at Setpoint

💡 Lessons From a Market Wake-Up Call: Recent failures in asset-backed finance have raised the bar for transparency and control—our Head of Capital Solutions, Bart Steenbergen, breaks down what’s driving this reset and the verification standards lenders need to meet rising expectations from boards, investors, and regulators. Download the whitepaper.

🚀 We’re growing at Setpoint: Fresh off being named 2025 Fintech Game-Changer of the Year by Opportunity Austin’s A-LIST Awards and #1 Startup in Austin on LinkedIn’s 2025 Top Startups list, we’re expanding our team across key roles. Check out our open positions.

🤝 On the road this winter — let’s connect. We’re attending a number of industry events in the coming weeks. Here are three upcoming conferences our team will be attending, and we’d love to meet you.

MBA’s Independent Mortgage Banker’s Conference | Feb. 2-4, Amelia Island, FL. Book time with our team.

FFA’s Global Fund Finance Symposium | Feb. 2-4, Miami, FL. Book time with our team.

SFVegas 2026 | Feb. 22-25, Las Vegas, NV. Book time with our team.

💸 Debt Financings & Acquisitions

AB CarVal expanded its CRE private credit capabilities through new partnerships with Cedarline Lending to fund homebuilder loans, Sunday River to fund first lien transitional multi-family loans, and North River Partners for multi-family construction loans.

Alterra IOS, an industrial outdoor storage (IOS) acquisition platform, closed a $100M revolving credit facility with BMO to support its acquisition pipeline.

Atlantic Screen Group, a UK-based music and media company, raised $30M from Corrum Capital to finance acquisition of film and TV scores.

Block (fka Square), a financial technology and payments platform, has surpassed $200B in global lending volume since inception across Cash App Borrow, Afterpay, and Square Loans.

Bolton Capital, a specialty finance platform for the bulk hauling and transportation industry, closed a $20M revolving line of credit from Texas Capital.

Crayhill, a credit fund, and Monarch Private Capital, a tax equity investment platform, closed a $300M JV to facilitate tax equity investments for renewable energy projects.

Dext Capital, an equipment finance platform, closed its sixth ABS transaction.

Duetti, a music investment company focused on indie music rights, closed a $50M Series C led by Raine Group alongside a $125M private ABS transaction. They also launched the Music Finance Index in partnership with Billboard.

eHealth, a private online health insurance marketplace, closed a $125M asset-based revolving credit facility with Comvest.

Elevex, a commercial equipment finance platform, closed a $1B forward flow agreement with TPG.

Encina Lender Finance, an asset-based credit platform, closed a $75M senior credit facility to a specialty finance company to scale origination of its consumer lease-to-own assets.

EquipmentShare, a connected jobsite and construction equipment rental platform, filed its S-1.

GLS, an auto finance platform, raised $225.3M in a new securitization backed by a pool of prime auto loans.

GM Financial, the captive finance company for GM, raised $1B in an ABS issuance secured by a pool of prime retail installment auto loan contracts.

Goal Investment Management, a private credit manager specializing in US consumer assets, formed a JV with Ares to acquire consumer loan portfolios.

LuminArx, a global asset manager, closed a capital solution for counterparties of an IG issuer to convert $140M in future payments due over eight years from the Issuer into immediate proceeds.

Marblegate Capital, a fleet operator and specialty finance lender in the NYC taxi market, closed a $120M term loan with DZ Bank and a $17.2M term loan from Auxilior Capital Partners to expand its Signal Taxi operation.

OneMain, a consumer finance platform, announced a $2.4B forward flow program with TPG.

Pagaya, a consumer finance and residential real estate platform, closed a $350M revolving personal loan ABS with investment from 26North.

Perseus Aviation, an aircraft leasing and finance company managed by Apollo, is preparing to sell $680.1M in an ABS deal secured by lease revenue on a portfolio of 27 aircraft assets.

Reach Financial, a consumer finance and debt settlement platform, raised $550M in its first ABS issuance of 2026 secured by a pool of unsecured consumer loans.

RESIDCO, a transportation equipment asset manager, closed a $100M commercial aircraft acquisition facility from Huntington Bank.

Stellify Capital, an equipment finance platform, closed a $75M credit facility with SLC Management.

Stream, a cash advance platform, closed a $10M senior credit facility from Pier Asset Management.

Targeted Lending Co, an equipment finance platform, expanded its senior credit facility with Wells Fargo to $125M.

Westlake, a technology-based auto finance company, raised $1.3B in an ABS deal secured by prime, subprime, and near prime contracts financing new and used vehicles.

💰️Platform Growth

Ares raised $7.1B for its Credit Secondaries Strategy, including the final close of Ares Credit Secondaries Fund.

Benefit Street Partners closed $10B for its flagship US Real Estate Debt strategy to originate senior and junior CRE debt investments across US with emphasis on multi-family.

Brookfield announced its private wealth platform launched Oaktree Asset-Backed Income Fund (OABIX) with $400M in committed capital.

CVC will manage insurance-focused private credit mandates for AIG of up to $2B, with an initial 2026 deployment target of $1B.

Davidson Kempner announced the final close of DK Income Fund II, the firm’s global asset-backed private credit fund, to over $1.1B to invest across structured residential, corporate, specialty finance, and hard asset-backed loans.

Invesco launches European Upper Middle Market Income Fund (ELTIF 2.0) to invest in a portfolio of European upper middle market, senior secured corporate loans.

KKR increased its ownership stake in Altavair and AV AirFinance to deepen an existing partnership under which KKR has committed over $5B to aircraft leasing and lending transactions.

KKR acquired Arctos Partners, a sports and secondaries investor, for over $1B

Monroe Capital announced the final close of its 2025 Monroe Capital Private Credit Fund V with total investable capital of $6.1B to provide senior secured loans to lower middle market US companies.

Nassau Global Credit, a $7B AUM multi-strat credit manager, launched a new Credit Opportunities strategy with commitments of up to $400M to deploy in performing, opportunistic, and structured credit.

Patrimonium, a Swiss asset manager with €5B in AUM, entered into a strategic partnership with Bayview to launch a Commercial Real Estate lending platform with €500M in commitments.

SCIO Capital, a UK-based asset-based private credit fund, closed a $600M commitment from Moody Aldrich Partners.

Sixth Street announces the final close of Sixth Street Specialty Lending Europe III (SLE III) at its hard cap of €3.75B to provide financing solutions for companies across Europe.

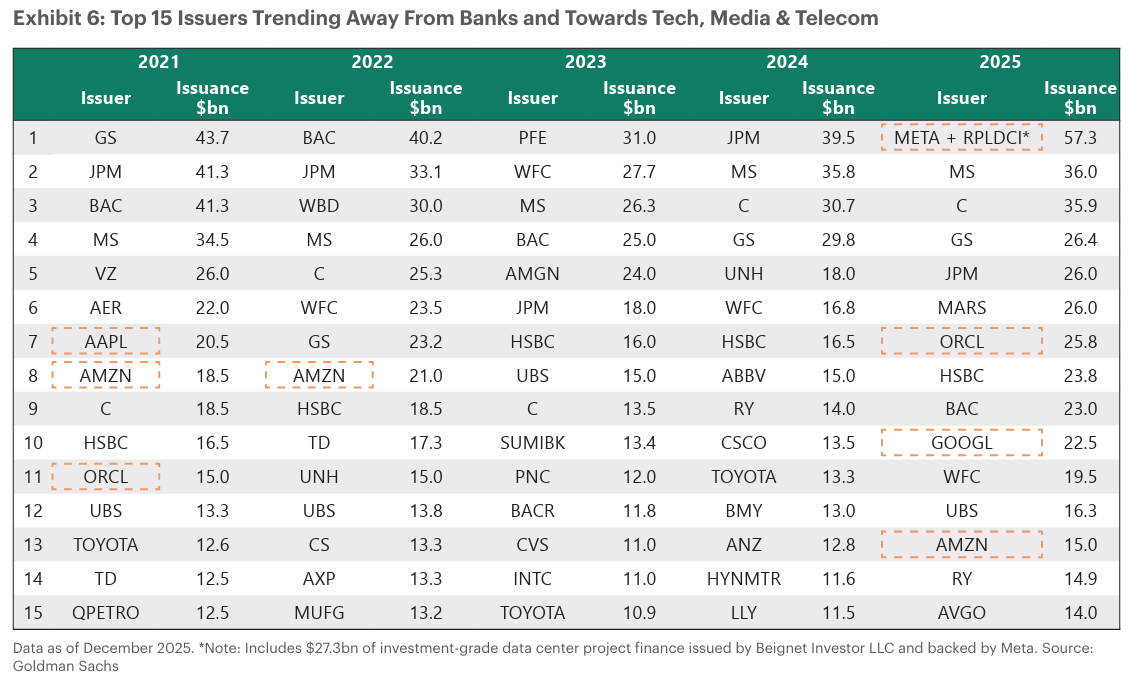

📈 Visuals

🗣️ Market Commentary

“We’ve built the capability in private credit over these past few years. It’s now a significant contributor to our balance sheet. In 2024 when [my deputy CIO] would’ve spoken to you, it was the best performing asset class for us. Last year it was strong, mid-double digits. I think there’s more headwinds in that space, but if you’re with the right partners and given the platforms we’ve built over the past few years, we remain quite bullish and firm on that space.“ - Khaldoon Al Mubarak, CEO of Mubadala, on private credit opportunities in 2026

“Against the backdrop of European banks avoiding more complex, bespoke financing, there is a significantly lower quantum of leveraged credit investor capital in Europe – 5% in Europe versus 12% in the U.S. in GDP terms – resulting in less competition.28 Among the non-bank lenders in Europe – where there is roughly 50% of the private credit capital in GDP terms compared with the U.S. – there tends to be less scale and structuring depth. The gap is magnified for SMEs. By expanding the credit package to include revolving facilities, backed by accounts receivable and inventory, and term facilities, backed by property, plant and equipment and cash flow across different countries, an agile lender is able to structure a more holistic and efficient financing package that aligns with a borrower’s working capital needs and growth plans” - Davidson Kempner on the Private Credit and ABL Opportunity in Europe

“When an industry grows this fast, there are going to be bumps and scrapes. There are going to be increases in defaults which are going to create headlines. Credit spreads are tight right now, so it’s a time to be thoughtful and defensive rather than lean in. Skewing away to the more complex, artisanal…large scale complex deals is where we’ve been able to generate returns as opposed to just bidding down the plain vanilla leveraged finance transactions. Large cap direct lending has been tight. Anybody who thinks otherwise isn’t really talking plainly.” - Julian Salisbury, Sixth Street Partner and Co-CIO on market dynamics in private credit

“For the purposes of this call, given how little we know at this point, the way I would prefer to talk about it is just assume for the sake of argument that something in the general mode of price controls on credit card interest rates goes through, what would be the consequences of that. And I think the first thing to say, which you obviously know very well, is that the card ecosystem is an exceptionally competitive ecosystem. It's among the most competitive businesses that we operate in.And that's true for all levels of borrower credit score from a high FICO to low FICO. And so, in that context, just basic economics, when you start with that as your starting point, the right assumption about what the response of the system is going to be to the imposition of price controls is not that you will simply compress the profit margins, which are already at their sort of competitively optimal level, and thereby, pass on benefits to consumers. What's actually simply going to happen is that the provision of the service will change dramatically. Specifically, people will lose access to credit like on a very, very extensive and broad basis, especially the people who need it the most, ironically.And so, that's a pretty severely negative consequence for consumers, and frankly, probably also a negative consequence for the economy as a whole right now. I don't want to let this pass without saying that I think it should be obvious that that would also be bad for us. I'm not going to get into quantifying.” - Jeremy Barnum, JPM CFO on Potential Risks to JPM, Consumers and the Economy driven by Proposed Regulatory Caps on APRs

“We will be spending more in – I think that AI – we will be spending more, but it is not a big driver. I do think it'll be driving more efficiency down the road. But I'd also point out about that, efficiency, because other banks have to do it too, will eventually be passed on to the customer. This isn't like you're going to build 3 points of margin and you get to keep it – you don't. So, you need to build some of these things just to keep up. And you know we have – we look at – and we look at all of our competitors, but those competitors include all the fintechs. You have Stripe. You have SoFi. You have Revolut. You have Schwab. You have everyone out there. And these are good players, and we analyze what they do and how they do it and how we'd stay out front. And we are going to stay out front, so help us God. We're not going to try to meet some expense target, and then 10 years from now you'll be asking us the question how did JPMorgan get left behind.” - Jamie Dimon, JPM CEO on AI Spending and Fintech Competition

📖 What We’re Reading & Listening To

Earnings

Investment & Macro Outlooks

2026 Credit Outlook: From Scarcity to Selection - The Return of a Buyer’s Market (Apollo)

2026 Market Outlook (Axar Capital)

Medalist Partners 2026 Securitized Credit Outlook (Medalist Partners)

Reading

Diameter Q425 Quarterly Letter (Diameter)

Less for You, More for Me: Credit Reallocation and Rationing Under Usury Limits (NY Fed)

Private Credit: A Primer on a Broadening Asset Class (BlackRock)

The Perfect Storm: Why We Are So Bullish on the Asset-Based Private Credit Opportunity Set (Castlelake)

Podcasts & Interviews

Europe (The Insight from Oaktree)

Rapids of Private Credit: Opportunities in the Eddies of ABF (DK Extra Credit)

Scott Kleinman - Apollo’s Integrated Alternatives Platform (Capital Allocators)

Ted Koenig on Deploying $100B in Private Credit (Forged in America)