- The Data Tapes

- Posts

- The Data Tapes

The Data Tapes

Setpoint's Bite-Sized Debt Newsletter: November Edition II

The Latest in ABS and Debt Markets

Welcome to The Data Tapes—your biweekly snapshot of private credit and ABS markets. In each edition, we bring you concise updates on debt financings, platform fundraises, data insights, market trends, and the latest from Setpoint.

🚀 What’s New at Setpoint

📽️ Setpoint on NYSE TV: Our Co-Founder and CEO, Stuart Wall, sat down with Ashley Mastronardi at the NYSE to discuss PledgeCheck, our newest product designed to help lenders & borrowers verify collateral integrity and prevent double pledging—bringing greater transparency and trust to the asset-backed finance ecosystem. Watch the full interview.

🎧 Beyond the Double Pledge — Building Trust in Private Credit: On The Credit Clubhouse, our Co-Founder and CEO Stuart Wall explains why stronger operational standards are needed in asset-backed finance, and how PledgeCheck helps rebuild confidence between lenders and borrowers through independent verification. Listen via DealCatalyst, Apple, YouTube or Spotify.

✅ PledgeCheck — A New Standard for Collateral Integrity: For decades, asset-backed finance has relied on borrower attestations and manual reviews — creating blind spots around whether assets are truly unique and properly pledged. PledgeCheck changes that, giving borrowers and capital providers a shared, independent certification of collateral integrity. Learn more.

🤝 We’re on the road — let’s connect: We’ll be at a few more industry conferences before 2025 comes to a close, and we’d love to meet.

SFR West, Dec. 2-4 — Scottsdale, AZ | Meet with us.

Opal ABS & Fintech Specialty Finance Forum, Dec. 9-11 — Dana Point, CA | Meet with us.

💸 Debt Financings & Acquisitions

American Community Lending, a real estate bridge lender, closed a $17.5M IG corporate note financing to support lending operations and portfolio growth.

Americor, a debt settlement platform, closed a $153.15M rated ABS deal collateralized by debt settlement fees. This represents the first rated debt settlement deal secured by settlement fees.

Aviva, a Mexico-based consumer finance platform, closed a $50M debt facility with CIM.

Beequip Equipment Finance, a Dutch equipment leasing platform owned by Apollo, closed a $576M ABS deal backed by leases for cranes, containers, maritime, and construction equipment.

Bonside, a brick-and-mortar retail financing platform, closed a $100M capital partnership with i80 to scale origination volumes through Bonside’s Repeatable Revenue Agreement (RPA).

Cardinal Capital Group, a private lender to real estate investors, closed its first RTL securitization backed by $130M in collateral.

Capital On Tap, a UK-based small business credit card and spend management platform, closed a £500M asset-backed securitization secured by a pool of business credit card receivables.

Cornerstone Financing, creator of Cornerstone Home Equity Insurance/Investment Funding Solutions (CHEIFS), announced a strategic asset purchase agreement of up to $1B with Fortress.

Credit Acceptance Corp, a consumer auto lending platform, closed a $500M asset-backed financing.

Drip Capital, a global trade finance platform, closed a $50M credit facility with TD Bank to support Drip’s Buyer Finance program in the US and Canada.

ElmBlue Equipment Finance, a commercial equipment finance platform, raised a $125M credit facility from Wells Fargo to support additional lending capacity and scale originations.

Keyzy, a UK-based rent-to-own platform, closed a £130M asset-backed, OpCo-PropCo partnership with Crayon Partners to expand its portfolio by 250+ homes in the greater London area.

Klarna, a consumer BNPL platform, has agreed to sell up to $6.5B in long-term loans to funds controlled by Elliott Management, scaling the forward flow partnership they struck last year.

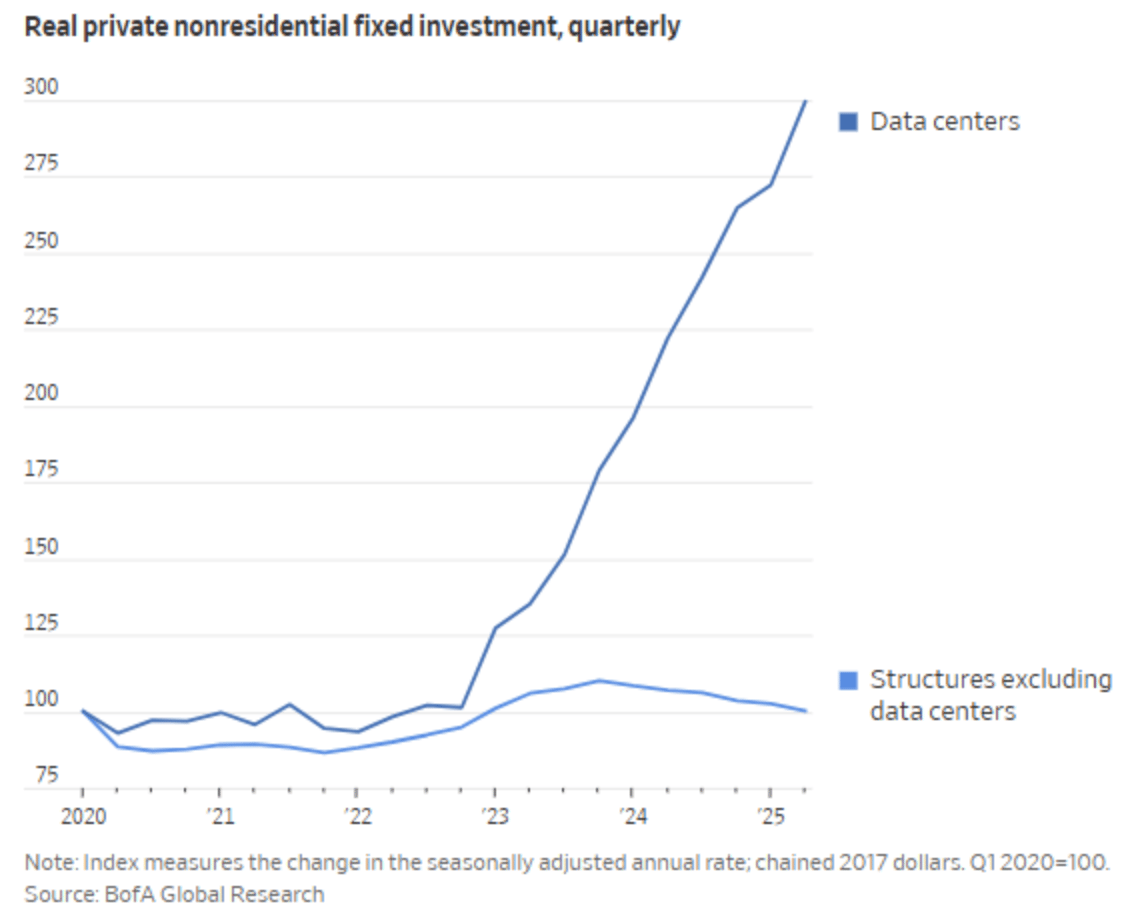

Lambda, a GPU cloud business, raised over $1.5B in its latest funding round led by TWG Global to continue to buy additional GPUs and build its own data centers.

Lighter Capital, a revenue-based financing platform for SaaS and technology businesses, closed a new $100M senior credit facility with i80 Group to expand origination volumes.

Nelnet, a student loan servicing platform, closed a $745.1M ABS issuance backed by a pool of private student loans.

PayPal, a consumer payments and credit platform, has agreed to sell up to €65B in BNPL loans to KKR as part of an extension to a two-year forward flow agreement that was struck in 2023.

Pier Asset Management, a Los Angeles-based credit fund, closed a $15M senior secured credit facility to a construction payments and financing platform.

Quantum Lending Solutions, a credit underwriting and small business lending platform, raised $400M in combined debt and equity from ATLAS SP, an unnamed private credit firm, and LL Funds.

Regents Capital, an equipment leasing and financing platform for middle market borrowers, extended and upsized its credit facility with Bank OZK to $150M to fund new originations.

SAPI, a UK-based small business finance company, closed a $75M debt financing with Hudson Cove alongside a $5M equity financing.

TeamShares, a tech-enabled acquirer of small businesses, announced its combination with Live Oak Acquisition Corp V, a publicly traded SPAC, supported by a $126M common equity PIPE anchored by T. Rowe Price Investment Management. Investor Presentation can be found here.

TruckSmarter, a freight software platform, announced the sale of its factoring business to OTR Solutions.

Unlock, a home equity investment platform, closed a $303.5M HEA securitization sponsored by Saluda Grade.

Upstart, a consumer finance platform, closed a $320M ABS deal secured by a pool of unsecured consumer loans.

Virginia Atlantic Airways, a global airline, announced a $745M senior secured financing with Apollo secured by Virgin’s portfolio of take-off and landing slots at London Heathrow.

Wisetack, a home improvement financing platform, announced a partnership with LendingClub where LendingClub will purchase participation certificates from Wisetack’s existing forward flow production and originate larger-ticket home improvement loans in the future.

💰️Platform Growth

Arrow Global Group, a pan-European credit and real estate asset manager, announced a €1.5B Final Close for Arrow Lending Opportunities Fund I and a €2.7B close for its European Credit Opportunities and Related Credit Strategies.

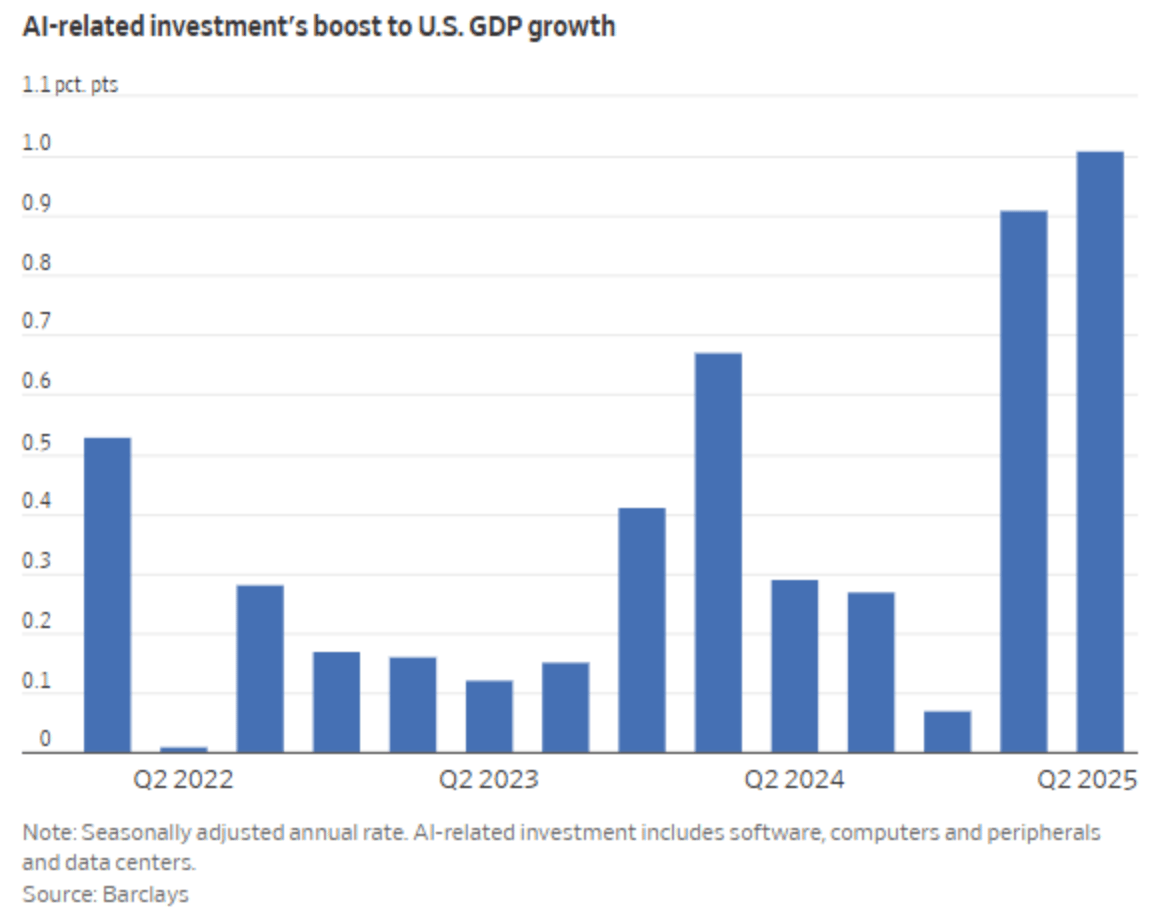

Brookfield Asset Management is launching a new AI infrastructure fund targeting $10B in equity, raising over $5B to date from investors including Nvidia, KIA, and Brookfield’s balance sheet.

Diameter raised $4.5B in new commitments for Diameter Dislocation Fund III to invest in market dislocations through stressed, distressed, and special situations.

Flagship Credit Acceptance, an auto finance platform, announced its acquisition by InterVest capital partners.

Greystar announced the final close of GO II to originate, purchase, and manage senior, mezz, and pref equity investments collateralized by for-rent residential assets.

Monomoy Capital Partners announced the final close of Monomoy Credit Opportunities Fund III, with over $500M in commitments to invest in senior secured debt in middle market businesses.

Monroe Capital closed a $730.7M private CLO secured by a portfolio of lower and traditional middle market senior secured loans.

Neuberger Berman raised $7.3B for NB Private Debt V, inclusive of leverage, to invest in senior secured, first-lien and unitranche loans to sponsor-owned companies.

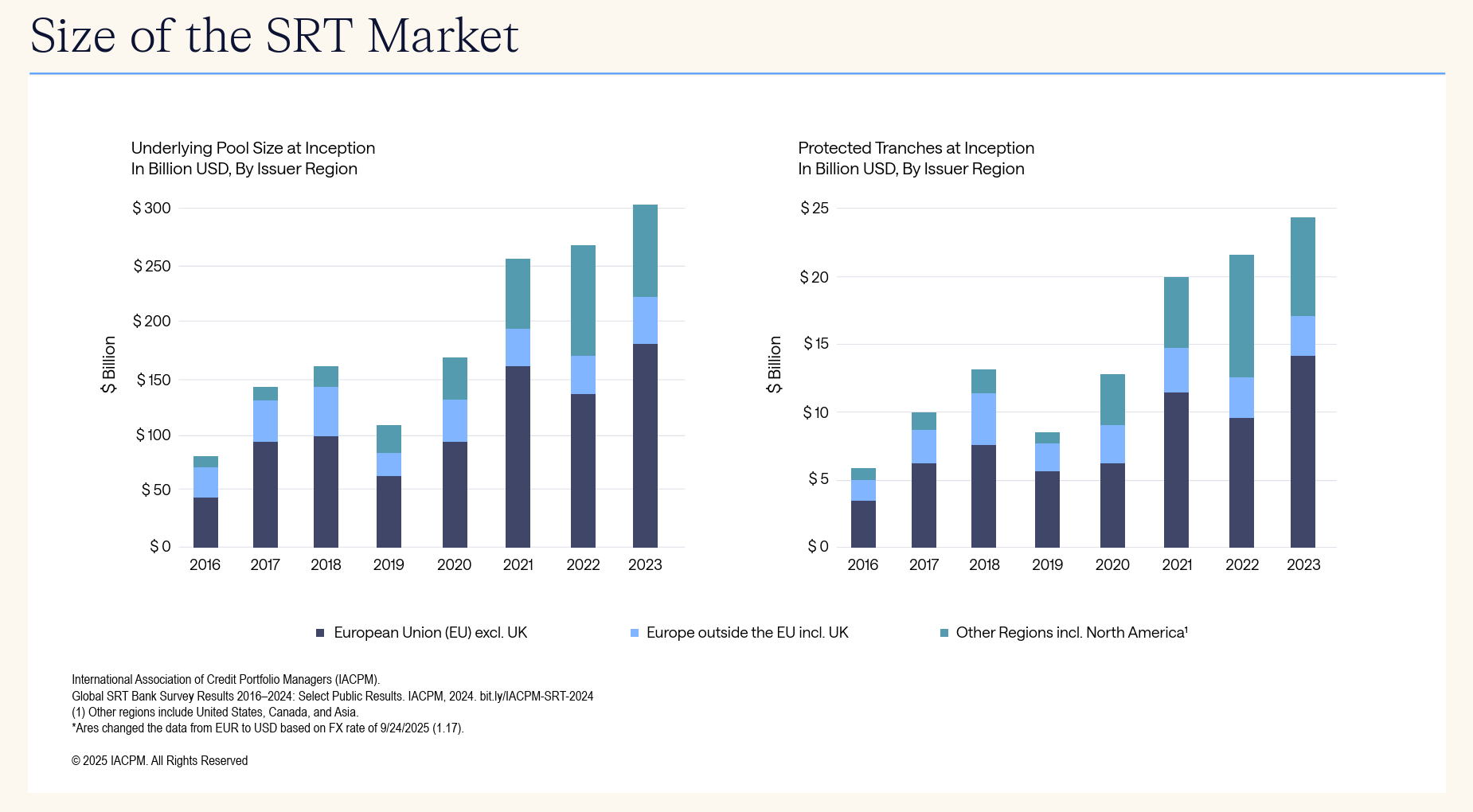

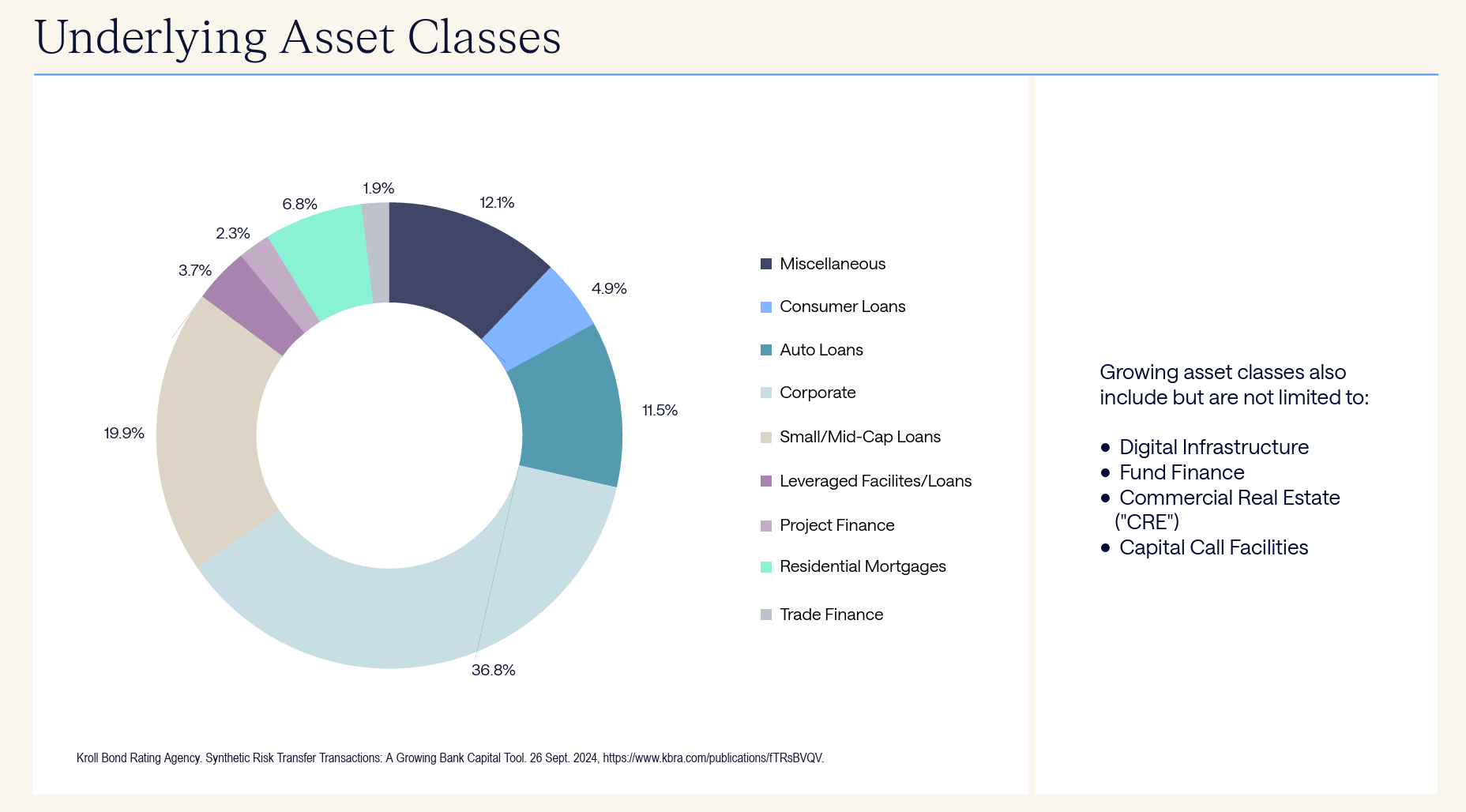

Newmarket, a Philadelphia-based credit fund, closed its fourth SRT fund with over $1B in commitments.

Pollen Street AUM has grown to £6.7B in Q3 2025, up 32% year over year, driven by private credit and private equity fundraising.

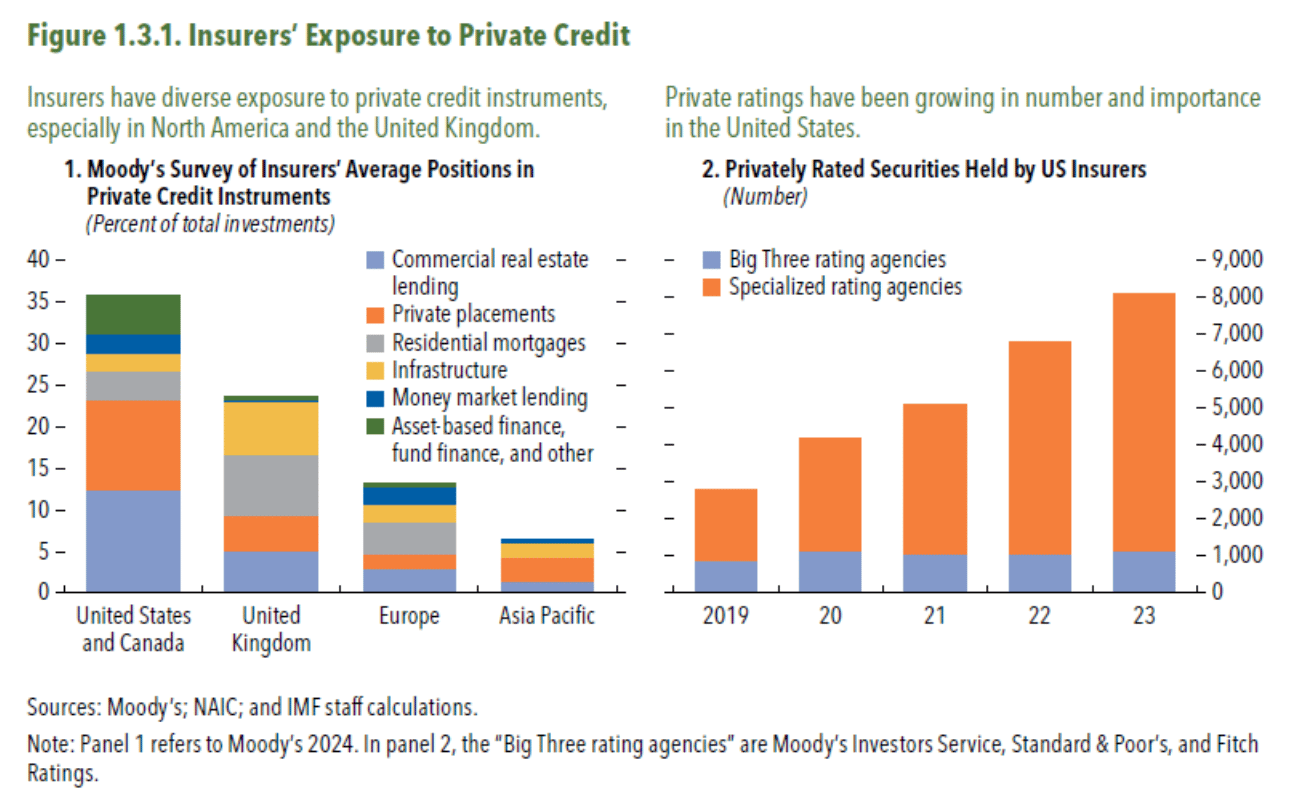

📈 Visuals

🗣️ Market Commentary

“In recent years, the garbage lending has not gone to the public markets. The garbage lending has gone to these private markets. Private credit has been very popular and now increasingly overallocated to by large asset pools. There are firms that were [marked] at 100 a few weeks ago and our now zero. The funny thing is that the argument for private credit has always been a Sharpe Ratio argument at the center of it. It’s that you get the same return or a little better return than the public markets, but you have much lower volatility. That’s like saying you have no interest rate risk in a CD. If you buy a 5-year CD, the price never changes. That’s just because you don’t mark it to market. Of course a CD that you bought 5 years ago at 1.5% is not worth - you couldn’t sell it at a par value. You’re going to have to take a discount on it. That’s the private credit argument. This was really borrowed from private equity. It’s like there’s only two prices for private credit - 100 or zero.” - Jeffrey Gundlach on ‘garbage lending’ in private credit

“Some of these investments are likely not going to work out, that’s just the reality when you have this much capital moving this fast. Hyperscalers aren’t asking for another developer, they’re asking for someone who can handle the grid, the megawatts, the land, and the build. We’re organizing around that.” - Raj Agrawal, KKR’s head of real assets on frothiness in the AI infrastructure trade

“To call private credit and direct lending ‘garbage lending’ is a way overstatement. People need to take a step back and take a breath. Lending has been around forever. Direct lending isn’t that different than bank lending. Its nonbank lenders doing it rather than traditional banks. There’s nothing really new about it. Of course, people can get carried away. I think the direct lending market is $1T or $1.5T. Some gargantuan number. For people who say there’s never going to be an issue, that’s just wrong. Conversely, for people who say it’s all going to come tumbling down, that’s equally wrong. What always happens on Wall Street when there’s a new idea - nonbank lending - is that people get carried away. Inevitably, mistakes are made. I would analogize this to the syndicated loan market, which is probably the best comp to the direct lending market. If you look back at 25-30 years of data, the highest that defaults ever went was around 10%. And that was at the height of the GFC in the midst of a crunching recession.” - Jeff Aronson, co-founder and managing principal at Centerbridge on defending private credit

“From our perspective, we find it tough to predict what the future looks like, what’s the use case for data centers, how much capital needs to go into them in 5-10 years time. We’ve been focused on investing in companies providing services around the AI space. From our perspective, that’s a better way for us to play this investment than compete with these firms that are focused on writing multi-billion dollar checks into the data center space. Those are massive checks. You really have to have a lot of conviction. And to compete, you have to have a lot of capital. We like to focus on areas where we can have an edge - I don’t think we necessarily have an edge to compete in these big data center projects. I also think when we look out at the spectrum, it’s tougher for us to have the conviction that we know what these assets are going to be worth 5-10 years in the future. We’d rather invest in other types of services or assets that we have a better picture on the long term visibility of values.” - Jack Neumark, Co-CEO of Fortress on different ways to play the AI theme

“There are going to be good asset managers and bad asset managers. One of the things we’ve said for a long time in the credit space and the private credit space is that it’s going to be hard to tell who’s doing a good job when defaults are really low. The reality is in credit, if you get paid your coupon you’re going to perform as expected. We’ve been investing in private credit going back to 2002 when we founded the credit business at Fortress. It’s really hard to differentiate yourself when there’s no defaults. When you start to have some defaults, you start to have a normal credit cycle, investment cycle, economic cycle, you’re going to start seeing a variance in returns. From our perspective, we’ve always invested deeply in the asset management part of the business which means taking care of those assets if you start to have the watch list. We actually believe this is an opportunity to outperform and differentiate from a performance perspective. - Fortress CO-CEO Drew McKnight on Opportunities in Asset-Based Credit and Investing in Asset Management

📖 What We’re Reading & Listening To

Invester Presentations & Outlooks

Reading

Americans’ Nest Eggs Built a Private Equity Loan Revolution (Bloomberg)

Beyond the Bubble: Why We Think AI Infrastructure Will Compound Long After the Hype (KKR)

Bubble Trouble 2 - GPUs: The Newest Asset Class (Net Interest)

First Brands Demise Has Lending Firm Raistone Seeking Rescue (Bloomberg)

GPU’s as Collateral - Chip Based ABS (Medium)

How the US Economy Became Hooked on AI Spending (WSJ)

Jon Gray is Reshaping Blackstone Into Everybody’s Investing Megastore (Bloomberg)

The Significant Risk Transfer Market: Proceed With Caution (Ares)

US Banks Have Developed a Significant Nonbank Footprint (Liberty Street Economics)

Podcasts & Interviews

Jeffrey Gundlach Says Almost All Financial Assets Are Now Overvalued (Odd Lots)

Joel Holsinger, Portfolio Manager and Co-Head of Alternative Credit at Ares (Weekly Bull & Bear)

Martín Escobari - Inside General Atlantic (Invest Like the Best)

Mike Kelly - Democratizing Access to the Middle Market at Future Standard (Capital Allocators)

Oaktree Worries About Lack of Discipline in Rush to Fund AI (Bloomberg Credit Edge)

Sound Point’s Steve Ketchum on Credit’s Revolution (Bloomberg Credit Crunch)